Tomorrow’s On June 12, all eyes will be on the Federal Reserve as it releases its dot plot of interest rate projections, complemented by Chairman Powell’s forward guidance. Additionally, the latest Consumer Price Index (CPI) data will be unveiled, providing crucial insights into inflation trends. These developments are anticipated to play a pivotal role in shaping market expectations, particularly within the digital asset sector. An interest rate cut, in particular, could significantly influence market dynamics, potentially driving investment and impacting valuations. Investors and analysts alike will be closely monitoring these releases to gauge the future trajectory of economic policy and its implications for the digital asset market.

Cryptocurrencies plunged further into correction territory on Tuesday, with Bitcoin (BTC) dropping to around $66,000 as traders prepared for Wednesday’s key U.S. inflation report and Federal Reserve meeting.

Bitcoin (BTC) began the day trading near $70,000 before hitting a three-week low of $66,170 during the U.S. session. It slightly rebounded to around $66,500 but remained down nearly 5% over the past 24 hours.

Altcoins experienced even steeper declines, with the CoinDesk 20 Index—a broad-market crypto benchmark—falling over 6%, and all twenty constituents in the red. Ethereum’s ether (ETH) dropped below $3,500, losing 6.5%, while Solana (SOL), Dogecoin (DOGE), Cardano’s ADA, and Chainlink’s LINK suffered 6%-9% losses.

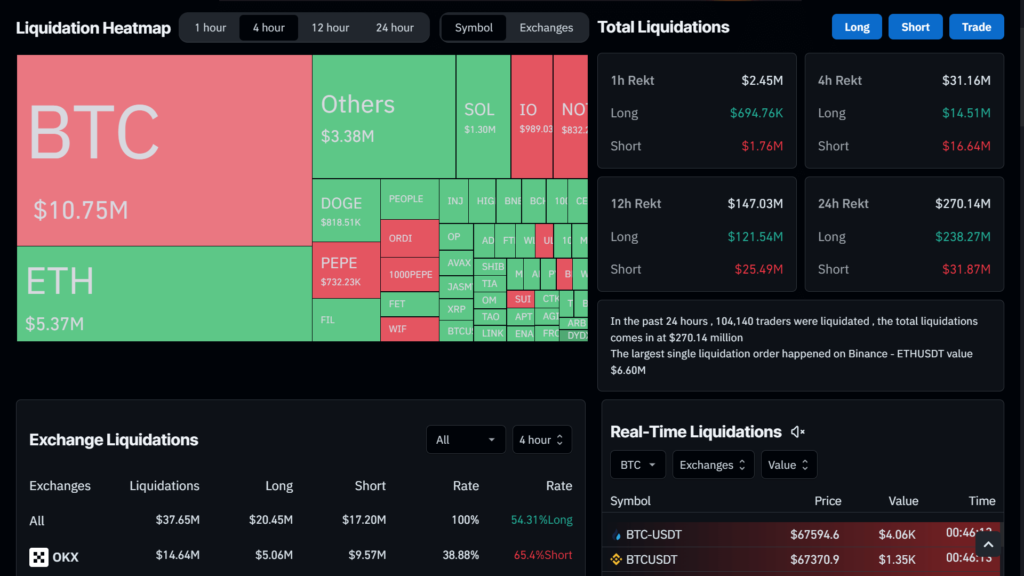

The abrupt downturn led to over $270 million in liquidations of leveraged derivatives trading positions across all crypto assets, according to CoinGlass data. This marked the second significant leverage flush within a week, following Friday’s $400 million liquidations.

Liquidations occur when an exchange closes a leveraged position due to a partial or total loss of the trader’s initial margin, typically because the trader fails to meet margin requirements or lacks sufficient funds to keep the position open.

One reason behind the pullback is investors “de-risking” from crypto assets ahead of tomorrow’s May Consumer Price Index (CPI) report and Fed meeting, hedge fund QCP said in an update.

Bitcoin could experience a volatile session on Wednesday, as it has been “highly responsive” to economic data recently, noted K33 Research in a Tuesday market update. They highlighted that Bitcoin’s 30-day correlation with U.S. equities has climbed to its highest level since 2022.

Investors will closely monitor the Federal Open Market Committee (FOMC) members’ interest rate outlook—referred to as the “dot plot”—to see how many rate cuts policymakers are projecting for this year in light of recent persistent inflation readings and softer economic data.